An Excerpt from ROI’s 2016 Mobile-First Ecommerce Manifesto

Retailers can no longer afford to snooze the mobile alarm. It’s already noon—time to get out of bed! Post-desktop ecommerce is approaching as the new reality. Even so, too many retailers continue to function as if mobile were merely an add-on strategy.

This is by no means a call to abandon desktop search optimizations in favor of mobile. While desktop traffic has indeed been stagnant for a couple years, the total volume doesn’t appear to have fallen – yet. Instead, mobile traffic has risen to the level of desktop, but so far appears to be additive.

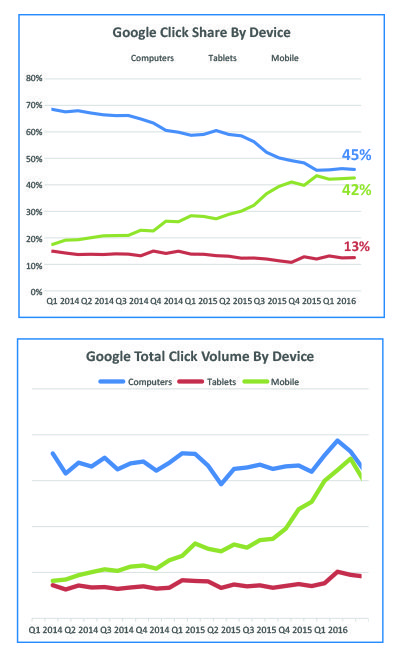

Using an initial framework of our own paid search marketing data to represent the mobile trend as a whole, the introductory section of this report will briefly highlight the mobile transformation over the past 9 quarters.

This report will then present high-level recommendations to guide you in reallocating your mobile investments in your website, Google Shopping, Amazon Sponsored Products, and Facebook Ads.

You can download the full 36-page, in-depth version of this report here.

Mobile Trends: Overview from a Paid Search Perspective

Mobile’s rise has been relentless.

Continuing at a pace in keeping with the most aggressive of projections, mobile paid search clicks are virtually on par with desktop. Restrict data to the top-performing Google Shopping channel, and the mobile future has already arrived. Mobile shopping clicks overtook desktop clicks sometime in the summer of 2015 and continue to rise.

In managing over $300 million yearly in paid search spend for ecommerce merchants, our insights are more than just anecdotal. The mobile trend line, while not unexpected, is meaningful nonetheless.

We’ve kept our paid search analysis on the following pages devoted to Google which dominates iPhone and Android device search. Over half of all Google paid search clicks are now coming from mobile devices.

Google Text and Shopping Ads by Device

Mobile is nearly at parity with desktop computers.

Two years ago, 70% of the click share was coming from desktops. Now desktop click share has fallen to 45%, with mobile clicks just shy of this mark, rising to 42%.

It gets worse for retailers relying on a primary desktop browser experience. When you consider that a touch-focused tablet experience is often closer to mobile than desktop, the dominance of desktop is already a thing of the past. Mobile + tablet click share is now 55%.

It’s not shown in the charts, but desktop text ad CTR has fallen by nearly 25% Y/Y according to our Q1 2016 data. An increase in search impressions over the same period has almost exactly compensated for the lower CTR, keeping desktop click volume steady.

Google may be artificially supporting desktop clicks for the time being through their ongoing aggressive optimizations of the desktop search experience, most notably in their expanded text ads. We expect to see a gradual decline of desktop clicks over the next few quarters after their optimizations catch up with them.

Google Shopping

55% of all Google Shopping traffic is coming from smartphones. In just two short years, that percentage grew nearly 300%, and although the numbers have started to stabilize, are you willing to ignore almost 55% of Google Shopping traffic? We didn’t think so.

55% of all Google Shopping traffic is coming from smartphones. In just two short years, that percentage grew nearly 300%, and although the numbers have started to stabilize, are you willing to ignore almost 55% of Google Shopping traffic? We didn’t think so.

Google Shopping offers prime search engine real estate you cannot afford to ignore. But many advertisers don’t realize that the key to increasing profitability in Google Shopping lies beyond the settings Google recommends.

Think of it this way, if you were at a blackjack table at a casino, would you let the house play your hand? Of course not, because they have their own best interest in mind. You certainly can’t blame them, but not utilizing your own custom setttings is killing your profitability.

Up until a few years back—assuming you weren’t crazy enough to want exactly the same mobile and desktop bids and ads— advertisers were required to create separate AdWords campaigns to target mobile devices. Due to the poor performance and low traffic of mobile, however, too many advertisers simply ignored mobile targeting altogether.

In an attempt to push advertisers to follow the rising trend of mobile search, Google converted all legacy campaigns to “Enhanced Campaigns.” Under this structure, which persists to the present, campaigns must now target all devices. To account for differences in performance, additional levers provide mobile-specific bid adjustment and ads.

This will be changing in the future as Google rolls out the complete overhaul of AdWords. They will be allowing bid adjustments to be made by device type (including tablets) at the campaign level, but that won’t happen until 2017.

Amazon Sponsored Products

70% of all of Amazon’s holiday SALES were from mobile. Amazon has done the hard work to make it simple and fast for consumers to get what they want.

70% of all of Amazon’s holiday SALES were from mobile. Amazon has done the hard work to make it simple and fast for consumers to get what they want.

Over 44% of web shoppers go directly to Amazon for product searches, skipping over Google, Bing, or other search engines entirely. With over 300 million active customer accounts, you can easily see why properly utilizing Sponsored Products can be such a powerful tool, well worth it as long as you can accept their commissions and control.

Whether you’re an expert or amateur in AdWords and marketplaces, Amazon Sponsored Products are an excellent way to add value to your marketing campaign. In 2015 alone, Sponsored Products accounted for over $1.5 billion in sales.

If you’ve worked in AdWords then you understand your level of ad spend has no real impact on organic search ranking. Regardless of what you advertise or how you do it, you aren’t improving your SEO. Conspiracy theorists might say otherwise, but they might also say the moon landing was a hoax.

Conversely, your level of ad spend in Sponsored Products directly impacts your organic ranking. The more customers you generate from any orders, including those from Sponsored Product ads, the more authoritative and dependable Amazon considers your company. As your ads reach a bigger audience, you’ll start to accrue more product reviews, gain more feedback, and gain more credibility from Amazon.

This is precisely what will help you improve your organic ranking over time and win the Buy Box more. That is, as long as you are doing things the right way and maintaining a high seller rating. Remember, lots of sales don’t mean much if you are receiving bad reviews and have poor customer service.

Although you won’t get the same brand recognition like with AdWords campaigns where customers are funneled to your website, improving your organic ranking will naturally increase your ability to win the Buy Box and appear in a better position on organic search pages.

Facebook Advertising

Here are the stats: 80% of Facebook traffic is mobile. 47% of their users ONLY use Facebook through a mobile device.

Here are the stats: 80% of Facebook traffic is mobile. 47% of their users ONLY use Facebook through a mobile device.

While Facebook already represents massive potential for retailers, there’s perhaps an even bigger reason to put yourself in the game. The writing is on the wall (and in overlooked announcements from Facebook) of an upcoming game-changer from Facebook. If Facebook plays their cards right, this can be an even bigger channel for ecommerce orders than Google!

You may have come across news on Facebook’s small-scale tests of an in-app shopping experience some months back. Once this platform is fully rolled out, after clicking your ad, users will remain within the Facebook app through the entire purchase process – from product selection to checkout to order confirmation. Retailers need not rely on a mobile optimized website or app of their own to convert mobile users. Facebook ads, some configuration, and your well-defined shopping feed would power this entire experience.

Assuming Facebook is able to get users to search for products instead of just passively scrolling upon product ads in their news feed, we will have an ecommerce revolution on our hands. This would be an Amazon Marketplace experience, except that retailers get to keep their full branding and ownership of their customers.

Would you like to learn more about Google Shopping, Amazon Sponsored Products, and Facebook advertising in a mobile-first world? Download our complimentary Mobile-First Ecommerce Manifesto to exploit these rising opportunities and advance your mobile footing in a post-desktop world.